Capitalising on 'Barbenheimer' with Audience Insights

After months of anticipation, the ‘Barbenheimer’ phenomenon made its impact on the box office. The opening debut weekend for both Barbie and Oppenheimer was not only the biggest box office weekend of 2023 thus far, but the biggest domestic box office weekend since 2019’s Avengers: Endgame.

With a combined global box office over the half-billion-dollar mark—Barbie bringing $337M globally, and Oppenheimer $174M globally—the ‘Barbenheimer’ effect unquestionably lived up to the anticipation.

That hype was reflected in a soaring number of pre-release tickets purchased; insights from Movio's Research Console show that 32% of opening weekend tickets for Barbie, and 36% for Oppenheimer were purchased at pre-release. The benchmark for pre-release tickets on a film’s opening weekend, by comparison, is 13%, which both films more than doubled. Of Oppenheimer’s pre-release tickets, the majority (61%) also opted to see Christopher Nolan’s latest blockbuster in IMAX or PLF formats over standard screens.

Barbenheimer brought back the Infrequent audience

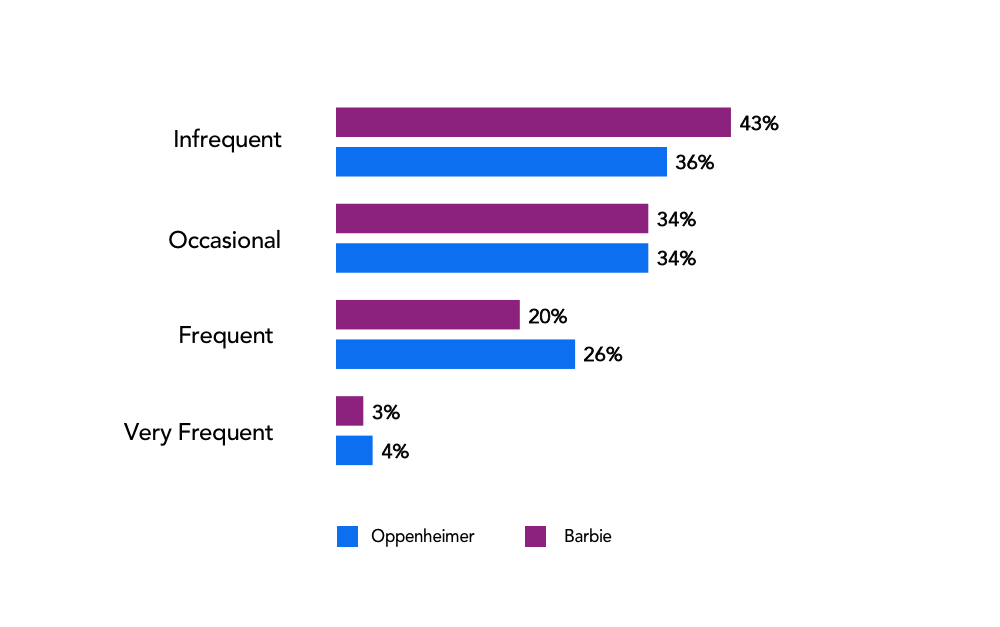

While Barbie was a clear winner from a box office perspective, both films were hugely successful at bringing a range of both Infrequent* and Frequent* moviegoers to the cinema.

Barbie attracted an impressive 43% of its audience as Infrequent moviegoers—with as many as 20% of moviegoers having not been to the cinemas for 6 or more months before seeing Barbie—showing the film had an incredible draw to bring moviegoers to the cinema.

Oppenheimer saw a similar 17% of their audience returning after 6 or more months. 36% of Oppenheimer’s audience were in the Infrequent demographic.

Given both films are stand-alone titles as opposed to sequels of part of a larger franchise, their ability to pull in such strong audiences without drawing on a prior loyal returning fanbase was impressive.

Audience overlap

One of the big questions is, of course, how much did the ‘Barbenheimer’ phenomenon play into the audiences for the films’ opening weekend?

While the expected audiences highlighted strong gender appeal, with Barbie drawing a 60% Female audience and Oppenheimer seeing 67% Males attending, the slice of the pie who decided to see both films was significant.

10% of all moviegoers who attended Barbie also went on to see Oppenheimer within the opening weekend, and over a sixth of all moviegoers watching Oppenheimer (17%) saw Barbie during the opening weekend.

(Barbie’s audience was larger overall than Oppenheimer’s, so that same overlapping audience comprises a different percentage of each film’s total audience)

The audiences had so much overlap, in fact, that Movio Research found that the most comparable audiences for each film were, surprisingly, each other! They also shared a number of titles in common for comparable films, including Spider-Man: Across the Spider-Verse, Asteroid City, and Guardians of the Galaxy Vol. 3.

How marketers can capitalise on 'Barbenheimer'

Barbie and Oppenheimer have made for a uniquely powerful success for cinemas. Other top record opening weekends in box office history were usually weighted with all the box office on a single film, such as with the debut of Avengers: Endgame. The fact that two films have managed to be so successful simultaneously speaks to how well they cater to different audiences, with strong gender appeal, and focuses on different formats—with Oppenheimer not having to compete for IMAX and PLF tickets, which Barbie excelled in standard format screens—is all the more evidence that the films are working hand-in-hand to create phenomenal box office. But there’s even more opportunity to bring more cross-film audience with the right marketing.

Marketers are rarely handed such a tantalising opportunity as the ‘Barbenheimer’ hype. By leveraging Barbie and Oppenheimer’s shared similar titles, there’s a strong marketing opportunity to target audiences who would have interest in both titles.

Audiences for both movies also saw Spider-Man: Across the Spider-Verse, Asteroid City, and Guardians of the Galaxy Vol. 3, meaning there is a strong propensity for those who saw each of those titles to purchase tickets to Barbie and/or Oppenheimer. Marketers could focus on the audiences for those three overlapping titles to grow attendance for both halves of ‘Barbenheimer’.

The audience overlap is substantial, but there are some outliers to it that could be capitalised on; Barbie has a chance to focus on targeting Female moviegoers who have watched Oppenheimer but not completed the ‘Barbenheimer’ journey.

Likewise, in the 18-34 age demographic—which was the highest-attending for both titles—there is strong conversion from both Male and Female moviegoers who saw Barbie then going to Oppenheimer, but Males who saw Oppenheimer and went to Barbie are trailing far behind Females in the same demographic. Marketers could try appealing to the Male 18-34 age range to engage with their 'Ken-ergy' and give Barbie a watch.

Where Oppenheimer has a strong Frequent moviegoer attendance typical of Christopher Nolan’s titles, Barbie’s audience is predominantly Infrequent moviegoers, meaning there is an opportunity to target the avid regular moviegoers to grow Barbie’s audience.

While the audience overlap is substantial in the opening weekend, there are many opportunities for how cinema marketers can capitalise on the opportunity these two films present to further increase this overlap and cross-pollination between the titles. Highlighting the films as a pair could see the overlap continue to grow into the second weekend of Barbie and Oppenheimer.

Movio Research provides the industry’s most comprehensive audience data to help you understand moviegoing audiences and plan the best ways to market to them. If you are interested in learning more about Movio Research, or to discover additional moviegoer insights, contact us, or see the latest audience overview every week with Movio’s Weekend Insights.

*Frequency is based on moviegoers’ six-month session count. Infrequent moviegoers have < 2 sessions in the past six months, Occasional moviegoers have 2-5 sessions, Frequent have 6-25, and those with 26+ sessions are considered Very Frequent.